Take advantage of digital transactions by using Vecaptos strategic coin development services to help your business grow. Our global team of experts works with each customer to develop intelligent strategies for effective use cases and their implementation.

Our solution saves our clients enormous overheads in managing their ICO/STO and creating the campaign or finding strategic partners, which can be used to develop the product, promote the token offering or present it at events for investors.

We support our clients in traditional and crypto-community marketing. We know the space well and we know the players in the crypto media industry. We connect you with our contacts and network partners to bring your project to the masses.

Investor Relations

We work with several investment platforms and partners through the world where our clients are positioned at the front-line in private meetings with institutional investors, family offices and high net worth individuals to find the best possible match.

EVENT ORGANISING & ROADSHOWS

With our team of experienced event organizers we support you with every kind of event you are planing. We have an excellent network in the Middle East and can work with local operators who can help organize the trip to maximize the reach for investors. We can also organize roadshows in Europe with our partners Coinscrum in London and Bitcoin Wednesday at events in Amsterdam.

COMMUNITY BUILDING & SOCIAL MEDIA MANAGEMENT

With over 10 years experience, we have deep understanding of social media and crypto based social campaigns - Our team has been a visionary and influencer in social crypto-media, and we work with some of the best community builders in the industry.

CONSULTING

You are interested in learning more about Tokenomics and the emerging ecosystem around Blockchain? We offer high level consulting and education programmes for startups and enterprise companies alike.

EXCHANGE LISTINGS

We work with a number of suppliers who have direct contact with multiple exchanges who can facilitate and assist with listing services.

FURTHER SERVICES INCLUDE

INFLUENCER MARKETING

WEBSITE AND ONLINE STRATEGY

VIDEO PRODUCTION

DOMICILE AND LEGAL

WHITE PAPER EDITING

THERE ARE THREE TYPES OF ASSETS:

INTANGIBLE ASSETS

are non physical assets. They exist only as a value whose ownership can be exchanged, such as loyalty program, copyrights or contracts for example.

FUNGIBLE ASSETS

are assets that never change in their core components, such gold, wheat or most commodities. No matter how many times it is split an ounce of gold, will always be gold.

NON- FUNGIBLE ASSETS

are assets that can’t be broken down into pieces and traded. These illiquid assets are typically not easily tradeable.

TOKENIZATION OF ASSETS IS THE SOLUTION

DISADVANTAGES OF IPOS AND CLASSIC EQITY INVESTMENTS

Only suitable for financially strong companies

High transaction costs and very capital Intensive

Very time consuming and exhausting process due to many middlemen

Intransparent and opaque cost and price structures

Complicated and slow implemantation precess

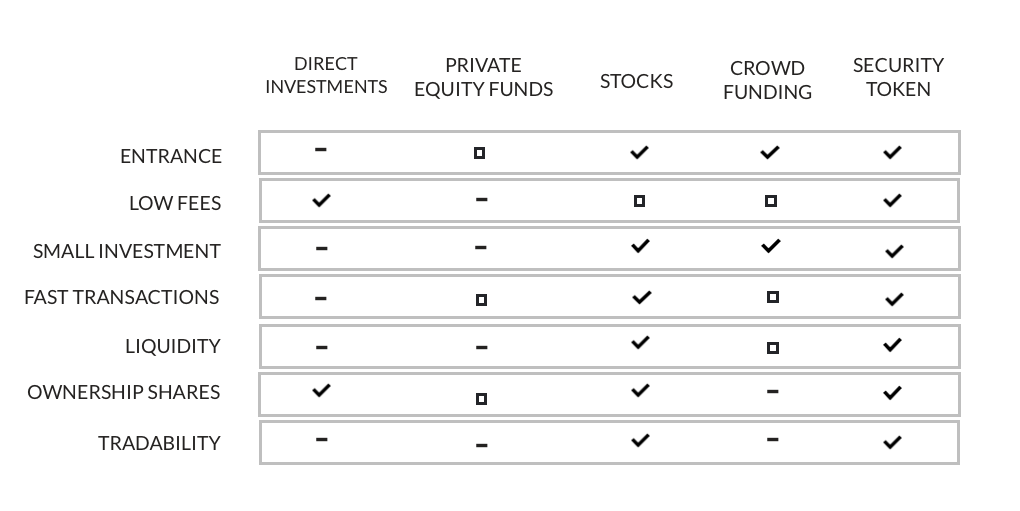

WHAT OPPORTUNITIES ARE THERE AT THE MOMENT TO INVEST IN SME?

Private equity funds

Direct investments as well as Crowdinvestments

Purchase of shares in (listed) companies

YOUR BENEFITS AND ADVANTAGES AS AN INVESTOR

Better access to new assets on a global scale

Lower transaction costs and faster transactions

Access around the clock with a greater diversification

Posibility of smaler investment amounts

Secure and protected standardize processes

YOUR BENEFITS AND ADVANTAGES AS AN ISSUERER

Cost reduction as well as rapid settlements

Built in complience

Scalability and accessible for global investors

Potential for 24/7 markets and standardized transactions

More liquidity and interm financing

(gap financing or bridge financing)

WHY WE BELIEVE THAT TOKENIZATION WILL BE THE FUTURE

1. Token standards are uniform

2. They can be easily bought and traded 24/7 by investors worldwide

3. Low entry barriers, flexibility and liquitity

4. Underlying Assets can be divided into smaller units through secure tokens

5. Compliance is programmable via restrictions, geo blocking or legal requirements via smart contracts 6. Increase in liquidity by lowering the minimum investment and onboarding new potetial investors.

7. Transparency by providing a unified method for tracking data.

8. Reporting and verification processes are much easier.

TYPES OF SECURITY TOKENS

Debt Token

Interest payments, Bond placments, Right to optain an equity interest and mandatory repayment of principal

Equity Token

Cash flow, dividend payments, voting rights, repurchase rights, invement in other funds, esop ( employee stock ownership plans), right to the substance

Utility Token

Utility tokens provide users with the later access to a product/service. With utility tokens, companies can raise funds for the development of the blockchain projects.

Asset backed Token

An asset-backed token is a token built on the blockchain platform which is associated with a tangible or intangible object of certain value.